|

Seattle City Council elections are upon us, and some 45 candidates are running for seven district seats. Seattle Fair Growth has been asked how we can influence these elections. Our response is to circulate a set of questions that reflect our concern for balanced growth and a livable Seattle. We urge you to attend some of the upcoming candidate forums, whether in person or by Zoom, and to contribute one or more questions when you have the opportunity. Several of our questions are meant to inform candidates about problems with existing programs, including the MHA, the MFTE and the new tree ordinance. We purposely didn’t oversimplify them to the point of generalizations. We’re asking you to circulate these questions to your neighborhood council or community group. Please share them now. The first candidate forum that we know of is for District 5, Monday. June 5th at Haller Lake United Methodist Church, 7 p.m. Many others are scheduled. Many candidates are requesting Democracy Vouchers. You may wish to call or email them or meet them for coffee when they are most appreciative of your inputs. With four of nine seats wide open, we have an opportunity to shape a more thoughtful City Council. Democracy is a participatory event! Sarajane Siegfriedt for Seattle Fair Growth sarajane3h@comcast.net Seattle Fair Growth Questions for City Council Candidates 2023

0 Comments

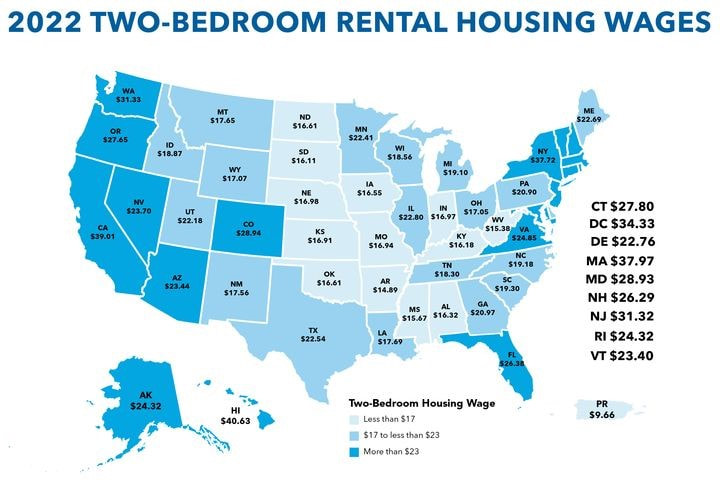

By Judith Bendich Today’s article in HufPost is enlightening and based on 2022 data. Real data, not wishful data. Please look at the USA chart below; the cost for a two-bedroom dwelling in Washington state requires an hourly-wage of $31.33. Our state and local minimum wages are far below that. Washington’s need for workforce housing is immense. That’s the real “middle.” Yet, the legislature is pushing the American Enterprise Institute’s “model bill,” called “middle housing” which isn’t “middle” at all and doesn’t help those who need housing the most. True, the legislature also has some bills for funding low-income housing, but nothing addresses the real middle. Calling a bill “middle housing” doesn’t make it so. The name is a fiction. As many of us have been saying and writing from the beginning, we need workforce housing, truly “affordable” housing, not market-rate plexes that do not mandate affordability and that benefit only those tied to the building industry. The bill needs a drastic overhaul. It’s time for Toto to pull away the cloak, bare the real truth, and for you – our elected representatives, who truly care about our people, do the right thing and enact legislation that really meets the people’s needs. The Hourly Income You Need To Afford Rent Around The U.S. The average full-time minimum wage worker can't afford rent in ANY state in America By Suzy Strutner and Casey Bond Updated Apr 13, 2023 Full-time workers who make minimum wage can’t afford a one-bedroom rental home in any state in the U.S. without spending more than the recommended 30 percent of their income, according to a report from the National Low Income Housing Coalition (NLIHC). The group’s annual “Out of Reach” report compares minimum wages and housing costs in states, metropolitan areas and counties across the country. This year’s results show the hourly wage rate needed for a “modest” two-bedroom rental in 2022 is more than double the federal minimum wage of $7.25 per hour in every single state. Nationally, a person would need to make $25.82 per hour to pay for a modest two bedroom rental home without spending more than 30 percent of their income on housing. For a modest one-bedroom rental, it’s $21.25. Even where local minimum wages are higher than the federal standard, it’s not enough. “No local minimum wages are sufficient to afford a one-bedroom rental home at the fair market rent with a 40-hour workweek,” the group states. National Low Income Housing Coalition 2022 data from the National Low Income Housing Coalition shows the hourly wage required to afford the rent on a two-bedroom home in each U.S. state and Puerto Rico. Of the 50 states, Arkansas has the lowest hourly income needed for a two-bedroom rental at $14.89, the report shows, but the state minimum wage is $11. Hawaii demands the highest income from renters. Workers need to make $40.63 to afford a two-bedroom in the Aloha State where the minimum wage is increasing to $12 on Oct. 1. Even accounting for areas that have higher-than-federal minimum wages, the average American would need to log 96-hour workweeks for 52 weeks per year to afford a two-bedroom apartment or rental home, according to the report, which notes that’s equivalent to about two-and-a-half full-time jobs. For the overwhelming majority, not even sharing a dual income with a federal minimum wage-earning partner would cover a two-bedroom rental in their state. It’s a grim outlook similar to the group’s previous reports, which also showed sobering disparities between income and rent. The report’s authors say poor political decisions are to blame, as well as the coronavirus pandemic, which has only compounded the problem. “Housing is a basic human need, but millions of people in America cannot afford a safe, stable home,” stated NLIHC President and CEO Diane Yentel in a previous press release. “The lack of affordable homes for the lowest-income people is one of our country’s most urgent and solvable challenges, during and after COVID-19; we lack only the political will to fund the solutions at the scale necessary. It’s time for Congress to act.” The minimum wage hasn’t kept up with inflation. In 1968, the federal minimum wage was equivalent to $13.16 in 2022 dollars ― nearly $6 higher than today’s actual federal minimum wage. It hasn’t kept up with the rate of productivity growth, either. If it had, the report notes, it would have been over $22 per hour in 2021. See the full report for more details. This article was updated with the latest data for 2022. HB 1110 Is a Developer Giveaway Disguised as Affordable Housing by Iskra Johnson A typical infill housing project in Seattle. For non-rental housing a 6-plex townhouse is the most profitable form of new construction. There has been more misinformation swirling around the packaging of Washington State’s “Missing Middle” housing bill than any other bill this session, and maybe that’s because there’s so much money at stake for the developer class. The bill, which began in the House, will upzone virtually the entire state, eliminate single family zoning, and override the ability of cities to regulate development in a way that meets their needs. The legislation is part of a bigger national movement to control zoning of neighborhoods at the state and federal level. In the next few weeks Washington State’s Senate will debate and vote on the revised House Bill 1110. In this article I will address the main arguments in favor of the bill and illustrate the ways in which they are misleading and false. The Housing Shortage PanicTo build support from voters, upzone advocates have promoted alarming statistics on the looming shortage of housing. The figures seem to inflate weekly, from a shortage of hundreds of thousands to millions. In this ongoing disinformation campaign the percentage of Seattle zoned for single family housing is wildly inflated up to 80%, when Seattle’s own Comprehensive Plan calculates 35%. No one mentions the effects of the upzones of the past 20 years, or acknowledges the planning that has created Washington’s existing growth management system. According to King County’s own Urban Growth Capacity Report, under recent cumulative up-zones Washington’s biggest urban county already has capacity for 400,000 more housing units. This is enough to meet population pressures through 2035 and the following 20-year planning period: enough capacity for 50 years. Yet organizations like Sightline and the Urbanists insist we can only meet this capacity if we obliterate single family neighborhoods. Also ignored, that post pandemic we are in a massive social transition, making accurate estimates of future population dubious. Work from Home is Work from Anywhere: It is no longer necessary to live near work for many industries: 59% of employees work from home all or most of the time. Does it make sense to continue upzoning a city as though tens of thousands of new workers will be coming, when those workers may be living in rural Montana or Mexico? The real shortage is in affordable housing. The State Department of Commerce calculates (accurately or not) that King County needs to add 282,132 units of housing by 2044, and 172,000 of those units are needed for those making under $50,000. But… Upzoning will not provide affordable housing.Fans of housing deregulation will tell you that housing is just like any other widget: If it’s too expensive, increase supply and the price will come down. This is the trickle-down affordability theory, and it is just as convincing as trickle-down economics. Surely if we build enough $800,000 townhouses, some house somewhere in 30 or 40 years will be cheaper — and trickle down to the lower middle class. The problem is that there is no proof that increasing supply through density makes housing more affordable, and plenty that shows the opposite, including research based on the Median Multiple, (which is used by the UN, the World Bank and Harvard’s Joint Center for Housing,) showing that higher density leads to higher prices. London School of Economics researchers from the Center for Economic Studies in Europe calculated that increasing density by one percent increases wages by 4 percent. But that one percent increase in density also increases renters’ costs by 21 percent. We cannot build our way to affordability, and it is dishonest to market HB 1110 as doing that. We don’t need economists to do studies to understand this in Seattle: we can simply look at the lived experiment on our streets. Almost 30% of Seattle’s housing has been built in the last 20 years. In 2000 the median price of a house in King County was $250,000. The price in 2023 — 87,169 housing units later — is $822,850. If increased density was going to bring housing prices down, why don’t we see it? When zoning restrictions are lifted the land itself increases in value. This makes purchase and construction of new housing more expensive. Costs trickle down to adjacent homeowners in the form of higher property taxes, and ultimately displacement, as has happened in the gentrification of Seattle’s Central District. Contrary to what class warriors like to say, which is that “the rich NIMBY homeowners” don’t want density because it will bring their property values down, it’s the opposite: they know their property taxes will go up because they will be taxed on highest best use (as confirmed by the King County Assessor). There are no meaningful provisions in the pending legislation to protect existing homeowners. They may well be priced out of their home simply because they suddenly live next to a six-plex. A new townhouse complex on Greenwood, 1,573 square feet, $789,990, $502 per square foot. Zillow estimates payments of $5,369 per month. If you are to get a conforming loan based on housing being 30% of your income you must make 16,107 per month or $193,284 per year. Is this “middle housing” for “middle income”?Where is that mythic affordable duplex used to promote abolishing single family housing? The housing that will be built under this giveaway to developers is market-rate housing. Developers build to make a profit, and townhouse 6-plexes are their pay dirt. They do not build duplexes and they do not build mid-sized rentals. Under the Missing Middle legislation builders will simply keep building what works for them best: luxury apartment complexes and blocks and blocks of high-end townhouses. Density Will Not Save the Environment . . . But It Will Destroy the Neighborhood In this push for density environmentalists have joined forces with developers to portray the urban single family home and yard as the cause of the loss of farmland and wilderness. They ignore the existing urban growth boundary that is our tool to preserve rural land. They ignore that 89% of homebuyers would prefer a single-family home with a backyard over a unit in a triplex with a shorter commute and that the pressure for urban sprawl will become even greater if those houses disappear in the cities. In spite of these truths, upzoning is presented as the “green” path. Upzoning’s brutalist reality is falsely billed as “gentle density,” when it is exactly the opposite. A walk through any neighborhood deregulated in recent upzones shows the way it works. A builder buys two houses on a block and puts in a fourplex. The light and privacy disappear and the house next door becomes less desirable, as well as more expensive as taxes rise. That house sells, and then two more, until only one or two houses are left in the middle of the street. Little or no parking is required in new construction and the street becomes a one-way tunnel of cars. As amenities of scale and livability that attracted homeowners to the neighborhood vanish, the two remaining houses become hostages to the new reality. Eventually, block by block, single homes disappear and with them the gardens and trees that support birds and wildlife. The neighborhood communities built through gardens and front yards, porches and conversations, also vanish. One of dozens of construction sites replacing sense of place with blocks of identical townhouses. Concrete is the new “green.” There are no trees or gardens to moderate summer heatwaves, and little natural drainage to direct water that falls during increasingly extreme rains.The environmental cost of new construction is enormous: 25–40% of all landfill comes from the construction industry. Studies on carbon footprint show again and again that the greenest house is the one that is standing. It is far less expensive to the environment to remodel than to tear down and replace. It is time to look at reality and not wishful thinking when it comes to the environmental effects of upzoning on neighborhoods. I don’t fault legislators for trying to engineer walkability, affordability, and environmental protection. But that is not what happens under housing deregulation. Deregulation hands the neighborhood to the for-profit building industry: Its job is to maximize return, not to build below-market housing for a teacher or a grocery clerk. Social Justice Arguments for Density are Misleading and False When advocates of upzoning run out of other ways to convince people that their single family home should be razed, they default to race and social justice. We are told that “because redlining” today’s single family neighborhoods must go. In the past, various racial, immigrant and religious groups were excluded from buying homes in certain neighborhoods. Banks restricted loans to areas with high populations of these groups, which were “redlined” on maps. This was reprehensible and racist policy: But upzoning today’s cities will not create reparations. Seattle’s Black population clustered in the Central District between downtown on the west and 34th avenue on the east. Asians clustered in what used to be called Chinatown and Japantown in the Jackson corridor. When redlining was abolished in 1977 racial and immigrant minorities began to move throughout the city. I grew up on the redline, one block from the official east border of the Central District. I remember the day the Lake Washington Realty at 34th and Cherry was firebombed for its part in redlining. I went to school in the CD and over the 15 years I lived there I walked every block of it. It was a family neighborhood of beautiful homes with yards and gardens and a tiny handful of apartments. Today the CD is predominantly white for two reasons. After 1977 the Black population had the freedom to move and chose to do so. And gentrification stimulated by the growth of high tech industries caused demand for housing to rise. When highly paid people come en masse into a community they bid up the price of existing housing. In the Central District and elsewhere, property taxes to rose to the point where people could not keep their homes. How does tearing down Section 8 and affordable rentals, gentrifying the Central District and the rest of the city repair the damages of past discrimination? It doesn’t. Social justice rhetoric is being used to exploit the real history of racial discrimination — purely for profit. The people benefitting most from retelling of the history of redlining are non-Black people with money. If The Missing Middle Housing Bill is Bad What Are the Alternatives? Zone for Corner Development There is a way to add density and affordable housing while preserving the contiguous green space and character of a neighborhood. Apartments, condos or 4-plexes can be restricted to the corner of a block. The Montrachet, above, is an example of many of the fine older apartment houses on capitol hill. It is the only dense development on the block, and its placement keeps the scale and historic fabric of the street intact. Unlike the new apartments being built in Seattle, (which are the smallest per square foot in the country), these are spacious. Currently listed, a 3-bedroom apartment with 1550 square feet is $3,400 per month. Much smaller new “3 bedroom” apartments throughout the city start at $4,500. Contrast the Montrachet with this modern developed block in Ballard: This is not the only way to increase housing supply.

Limit the Building of Townhouses and Encourage Alternatives The modern townhouse is housing built for a particular span of life. With 3–4 flights of stairs and a vertical footprint, the townhouse is inhospitable to raising children or to getting old, and is completely inaccessible to the disabled. This is architecture available primarily to the able bodied, the young, and the rich. If we are going to do social engineering through neighborhood planning, incentivize zoning for flats. We need many more stacked single-level homes with a shared elevator that allows people to age in place. Single-level living is also more convenient for families with young children, and it allows a greater diversity of generations in the neighborhood than housing with multiple stairs. Expand Varieties of Ownership Models Co-ops, co-housing, tenants in common and land trusts are some of the kinds of ownership that can be both more affordable for first time buyers and more supportive for people in their later years. Condominiums used to be the favored starter home, but liability issues and legal constraints have made builders skittish. We need to have sensible liability law for construction failures, and reverse the trend towards accumulation of exorbitant Home Owner Association reserves that is an overreaction to past liabilities. Condominium association fees are based on square footage, and many condominiums of 1,000 feet or more have fees of $1,000 to $2,000 per month. With property taxes, utilities and HOA fees a condominium can cost $3,000 per month, even without a mortgage. The state has the legal power to regulate HOA’s. To make condominium ownership an option for the low income and retirees, the state needs to step in and require justification of high fees. Reconsider Deregulation of Accessory Dwelling Units As with the quaint and unobtrusive duplex, the romance of the backyard cottage has helped fuel enthusiasm for upzoning in neighborhoods. In 2019 the city lifted many restrictions on ADU’s and DADU’s as a way to add more forms of “gentle density” to neighborhoods. In 2022, 988 units were permitted, compared to only 280 in 2019. Over half the increase has come from developers, who are using the new rules to build three houses on a lot, with some permitted as condominiums and sold separately. The price per foot, as with most new construction, is high, with a median price of $732,000 for a structure that is 1,000 square feet or less. Virtually the entire lot is covered with impermeable surfaces, and one structure is usually 3 stories tall, creating for the house next door a loss of privacy and light similar to that from a townhouse. Some cities are now allowing DADU’s to be 1200–1500 square feet, which obliterates any illusion of “cottage”. Meanwhile the permit costs and timelines for homeowners who want to build on their property are astronomical; it can easily take a year and $300,000 to build a modest detached unit. Is this gentle density? How many affordable single family rentals are being torn down to build them? A three-house complex may have less impact on a city block, but is $700 per square foot affordable housing? We should hit pause, and consider refining the regulations for ADU’s to take into account livability of neighborhoods, loss of existing housing stock and affordability. Limit the Power of REIT’s to Inflate the Housing Market If we want to find someone to blame for the high cost of housing, let’s take a hard look at how Real Estate Investment Trusts have outbid individuals to own increasing percentages of housing. In Seattle investor ownership has grown from 3% in 2000 to 9% in 2021. Nationally, 2021 saw investors buy up 18% of the homes sold in the third quarter. When homes are purchased as rental investments on a corporate scale, rents invariably rise. Individuals cannot compete with the deep pockets of the corporate investors, and once outbid may end up renting the very house they wanted to buy. Rather than going after individual owners of single family houses as the culprit of unaffordable housing, we should look at legal limitations on how much of the housing in a given area housing investors can buy. Limit the Demand Side of the Law of Supply and Demand Supply-side advocates say we have an affordable housing shortage because there is not enough supply. Also true: We have a shortage because of excess demand. Seattle created demand intentionally, by upzoning to allow suburban-sized business parks for the high-wage tech industry, as in South Lake Union. In 2017 under HALA (Housing Affordability and Livability Agenda) the City Council upzoned the University District to allow a technology corridor with projected job density greater than South Lake Union’s. It was a choice: we didn’t have to do this. It’s curious that many of the same people pushing for lifting zoning restrictions adamantly oppose adding lanes to freeways. They know that you can’t solve traffic congestion with more lanes, as the traffic simply expands to fill the new lanes. The same principle applies to cities. If you add more jobs, you will need more housing. We need to have a citywide conversation about growth and livability, and about how to manange growth so that it doesn’t destroy the very things that made Seattle desirable in the first place. As long as we continue to insist that there is no limit to growth we will never be able to keep up with demand. In closing, we must challenge the deceptive rhetoric being used to steam roll development by urbanists, developers and supply-side ideologues. Statewide upzoning is not the cure for affordable housing, social-justice inequities, or environmental preservation. HB 1110 should go back to the drawing board for major revision, and other states considering similar legislation should take a long pause. Additional pieces of the tradeoffs between livability and affordability will be discussed in future essays in The Green Urbanist. I welcome your comments and discussion. All photographs ©Iskra Johnson  The Washington State Senate should not pass house bill 1110, which would allow four to six units on every residential lot in Seattle and take away local control on zoning decisions throughout the state. Yes, undoubtedly we have a housing crisis with an unconscionable number of neighbors living unhoused and rising housing costs. But is it because we don’t have enough room in our current zoning to build more housing? Definitely not. According to the 2021 King County Urban Growth Capacity Report, “[zoning] capacity is sufficient to accommodate the remainder of its 2035 housing and employment growth targets, and looking ahead, sufficient to accommodate projected future growth during the next planning period.” Similarly, the City of Seattle reports that Seattle currently has a population of 762,500 people and 388,133 housing units, with an average of 2.06 people per housing unit. Meaning Seattle currently has enough housing units for an additional 37,000 people above our current population. In other words, we have enough unoccupied homes to invite everyone in the city of Longview, WA to move to Seattle. Like a lot of bills that start with good intentions, this bill is going to lead to a great deal of unintended consequences. And most importantly it won’t work to fix our housing crisis. Why? Because we don’t lack the zoning capacity to build more housing, it's not a limiting factor. California passed a similar bill in 2021 that allows four units on every lot previously zoned as single family. But a recent study by the University of California, Berkley showed it did little to increase housing production and this bill will be the same. House Bill 1110 will further allow developers to build whatever they want, wherever they want in search of higher profits, not the higher good. This bill does not protect the historic buildings and districts that are important to Seattleites. In addition, it will stress our aging infrastructure, not allow for local planning, and threaten the already decreasing tree canopy that gives the Emerald City its nickname. Building more market rate housing will not address housing affordability. What we really lack is affordable, especially publicly owned, housing. And social safety nets to help our most in need. We only need to look to Europe with their vastly improved social welfare systems, to realize it is possible to have minimal homelessness, have dense cities, and have cities that are even (gasp!) attractive. Many European cities have considerable building regulations, resulting in buildings of a higher standard than we see in Seattle today. But it doesn’t lead to higher homelessness because European social safety nets are usually vastly superior to what we see in the US. We should follow this European model of improving social supports such as emergency rent assistance to address homelessness in Seattle and stop chasing a zoning problem that doesn't exist. Seattle should build more multi-family housing in the areas currently zoned for it, and there is plenty of capacity in current zoning to do so. Encourage more backyard cottages and attached apartments in neighborhood residential zones (previously known as single family). But if the State abolishes this last zone altogether, it will decrease the supply of single family homes on the market, which will further drive up the prices of these family friendly houses. And with many families still striving to own a single family home and build generational wealth, it will put this American Dream out of reach for even more people. On March 17th, the State Senate will hold a public hearing on House Bill and sign up for commenting can be found here. Public comments on the bill can also be made electronically on this link. The Senate should vote no on the well intentioned but poorly thought out House Bill 1110. Susanna Lin The Missing Middle Housing Bill (WA House Bill 1782 in 2022) was much debated and amended in the Local Government Committee, passed Appropriations and paused in House Rules. Seattle Fair Growth brings you this Fact Sheet because the prime sponsor says it will “come back stronger” in 2023 without any of the 17 amendments. Therefore we’ve based this on the original bill.

Please do not sponsor or endorse any Missing Middle Housing bill unless it includes anti-displacement provisions and subsidies for low-income rental housing below 50% of Area Median Income. ________________________________________________________________________ (1)(a) Any city with a population of 20,000 or more …must provide by ordinance and incorporate into its development …zoning regulations… authorization for the development of all middle housing types on all lots zoned for detached single-family residential use and within one-half mile of a major transit stop. [ In other words, allow six-plexes, townhouses, and flats just like Seattle’s revised LR2 lowrise residential zoning ] (b)(i) Such cities must also allow development of duplexes, triplexes, and fourplexes on all other lots zoned for single-family residential use. (b)(ii) As an alternative to the requirements of this subsection (1)(b): (A) Any city with a population of 500,000 or more may alter local zoning to allow an average minimum density equivalent to 40 dwelling units or more per gross acre across the entirety of the city's urban growth area. [ In other words, 40 units per acre is roughly 5 townhouses on a 6,000 sq. ft. lot., just like Seattle’s recently revised LR1 lowrise residential zoning ] |

RSS Feed

RSS Feed